Sustainable Finance and ESG: Global Policies, Green Investment Strategies, and Inclusive Economic Transitions

Keywords:

Corporate Social Responsibility (CSR), Environmental, Social, and Governance (ESG), Green Finance, Sustainable Development Goals (SDGs), Sustainable Finance, Financial Inclusion, Green BondsSynopsis

It gives me immense pleasure to present the book titled Sustainable Finance and ESG: Global Policies, Green Investment Strategies and Inclusive Economic Transitions to students, faculty and readers.

The book has been divided into different chapters reflecting the importance of sustainable Finance and ESG. It will be helpful in terms of teaching and educating the students so that they manage the financial resources in the most efficient way.

We are thankful to all the contributors for their contributions to this book as authors and for providing insights into sustainable finance.

The book can be used for the development of the economy through the inclusive growth and prosperity of the different sectors. It also helps in reducing the burden on the financial resources.

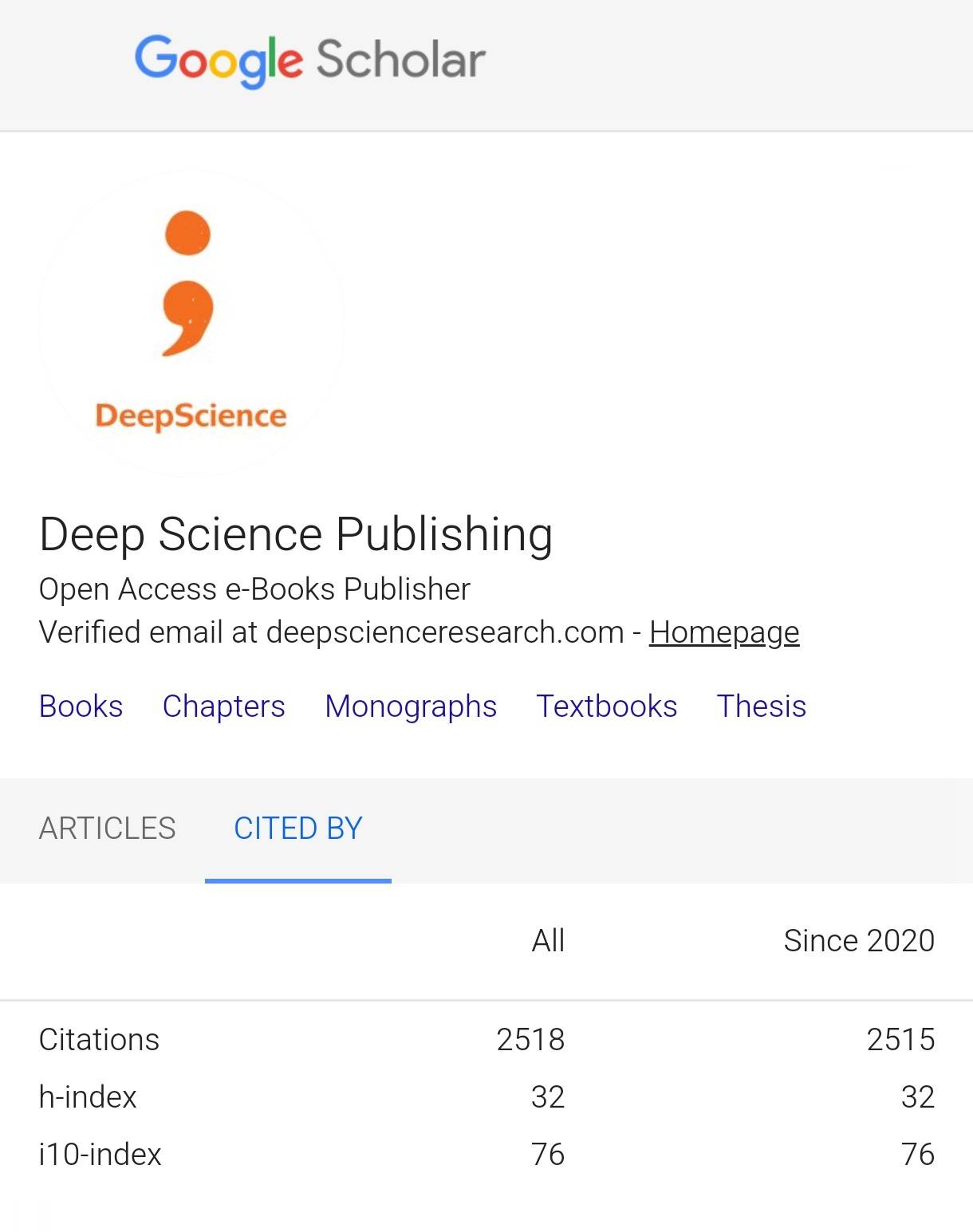

We are thankful to the Deep Science Publisher for their cooperation in the tedious editing and typesetting work and for bringing this book out in a very short period of time.

References

Faruq, A. T. M. O., & Huq, M. T. (2024). The role of central banks in advancing sustainable finance. arXiv. https://arxiv.org/abs/2411.13576

Pfister, C., & Valla, N. (2021). Financial stability is easier to green than monetary policy. Intereconomics, 56(3), 154–159. https://doi.org/10.1007/s10272-021-0972-y

Kenyon, C., Berrahoui, M., & Macrina, A. (2022). Transparency principle for carbon emissions drives sustainable finance. arXiv. https://arxiv.org/abs/2202.07689

Turek, M. (2022). A new approach to sustainable financial stability and its prospects. WSB Journal of Business and Finance, 56(1), 64–71. https://doi.org/10.2478/wsbjbf-2022-0007

Tkachenko, N. (2024). Integrating AI's carbon footprint into risk management frameworks: Strategies and tools for sustainable compliance in banking sector. arXiv. https://arxiv.org/abs/2410.01818

Kim, J. D. (2020). Transition towards green banking: Role of financial regulators and financial institutions. Asian Journal of Sustainability and Social Responsibility, 5(5). https://doi.org/10.1186/s41180-020-00034-3

Malik, M. S., Irfan, M., & Munir, S. (2024). Developing a sustainable finance index and its implications on inter-intra banking sector. SAGE Open, 14(1). https://doi.org/10.1177/21582440241271232

Rahman, S., Moral, I. H., Hassan, M., Hossain, G. S., & Perveen, R. (2022). A systematic review of green finance in the banking industry: Perspectives from a developing country. Green Finance, 4(3), 347–363. https://doi.org/10.3934/GF.2022017

Tan, Y. (2022). Modelling sustainability efficiency in banking. International Journal of Finance & Economics, 27(3), 2349–2367. https://doi.org/10.1002/ijfe.2349

Ferrer, R., Benitez, R., & Bolos, V. J. (2024). Interdependence between green financial instruments and major conventional assets: A wavelet-based network analysis. arXiv. https://arxiv.org/abs/2410.15751